By Ana Olivia A. Tirona, Researcher

THE PAST TWO years have been rough on micro-, small-, and medium-sized enterprises (MSMEs). According to the Philippine Statistics Authority’s (PSA) List of Establishments data, the number of the country’s MSMEs fell by 4.3% to 952,969 in 2020 from 995,745 the year before. The closure of around 43,000 of these firms led to approximately 130,000 jobs lost.

While analysts and the country’s economic managers expect economic output to return to pre-pandemic levels as early as the second quarter of 2022, they recognize that the economy is still “not quite out of the woods yet.” For MSMEs, there still needs for state support as they continue to stave off financial collapse.

Small Business Corp. (SB Corp.), the financing arm of the Department of Trade and Industry (DTI), hopes to continue providing that support.

The funding institution originated in 1991 as the Small Business Guarantee and Finance Corp. (SBGFC) with the role to invest in MSMEs in manufacturing, processing, agribusiness and services (with the exception of crop level production and trading). Through an executive order, SBGFC was merged with Guarantee Fund for Small and Medium Enterprises (GFSME) in 2001 to what would become SB Corp.

Since then, SB Corp. has been pushing to innovate its financing services and strengthen its institutional partnerships to enhance the access of MSMEs to low-cost credit. By 2025, SB Corp. looks to be the “leader in building financing alternatives” for the country’s MSMEs that would put them at the “forefront of inclusive growth.”

In particular, SB Corp. actively targets seven MSME segments: micro and small agri and aqua enterprises, micro retailers, small island economies, MSMEs requiring rehabilitation arising from disaster, Islamic MSMEs, indigenous people (IP)-owned enterprises, and first-time small businesses.

To know more about the financing institution, BusinessWorld reached out to the management of SB Corp. regarding its current and future offerings for the aspiring Filipino business owner.

What changes did SB Corp. have to make as a result of to the pandemic? Were there operational challenges, and if so, how were these being dealt with?

The pandemic has challenged the way we do business. We shifted last year to online application and processing of loans to reduce or eliminate face-to-face interactions, and to also fast-track evaluation and approval. We also streamlined our requirements to reduce processing time and become more responsive to the needs of affected businesses.

We have developed products to cater to specific segments that were heavily affected, such as the tourism, overseas Filipino workers (OFW), and retail sectors, aside from vulnerable MSMEs in the manufacturing, trade, and service sectors.

In May 2020, we launched the CARES Program or the COVID-19 Assistance to Restart Enterprises Program, which provided interest-free, non-collateral loans with grace periods of up to one year and up to four years to pay.

The initial funding allocation for CARES came from the Pondo sa Pagbabago at Pag-asenso (P3) Fund, as approved by the Governing Board and DTI Secretary Ramon M. Lopez.

With the enactment of Bayanihan II, our loan funds for the CARES Program increased. Congress allocated P10 billion for the CARES Program as equity to SB Corp. under Bayanihan II. However, the Department of Budget and Management (DBM) only [earned] P8.08 billion in November 2020.

We re-launched CARES in Oct. 2021 and renamed it Bayanihan CARES. The loan products under the Bayanihan CARES program include Helping the Economy Recover Thru OFW Enterprise Start-ups (HEROES) for OFWs, CARES for Tourism Rehabilitation and Vitalization of Enterprises and Livelihood (CARES for TRAVEL), Sustaining Trade Access to Primary Food and Link to Enterprises (STAPLES) for sari-sari stores, mini groceries, and other micro and small businesses in the retail chain, and Bayanihan CARES, the product itself. Just last November, we launched a new product for a limited period, called the 13th Month Loan Facility to help micro and small businesses fund their mandatory 13th month pay for employees and workers.

The products we developed in response to the pandemic are on top of the loan products we have for the P3 Program and for our regular corporate lending. The pandemic has made us very busy in responding to the financing needs of the MSME sector, especially as we were mandated by the government to provide credit for early recovery and provided with additional funds for the purpose.

There were a lot of internal challenges to us, especially the reconfiguration of our information technology (IT) systems for us to migrate to online lending, and the maintenance of a high level of quality and efficiency in our work despite work from home arrangements. The government’s response to the pandemic has increased our workload significantly, and we have responded to the challenge given the limitations.

Your firm looks to be the leader in the building financing alternatives for Philippine MSMEs by 2025 as per your vision statement. In what ways did current conditions affect the realization of said vision?

The current conditions have afforded us opportunities to pursue our mandate as we cater to MSMEs that are so called “unfinanceable,” or those that pose higher risks which the private sector is unwilling or unable to finance. These include those affected by calamities and hazards, small island economies, agri-aqua MSMEs, micro and small retailers, indigenous peoples, and the like. We provide financing and other forms of assistance to help them grow so that they can eventually engage the formal banking and quasi banking sectors. We provide the bridges for them to become stable, viable and sustainable so that they can become “financeable” by the mainstream finance sector.

In the future, we will pursue more purposeful and strategic interventions into these vulnerable and marginalized sectors so that we can catalyze the countryside and aide in urban development through affordable financing products and terms.

How would you characterize the demand among MSMEs on the programs offered by SB Corp.? Would you say this demand has been met?

There has been a large demand for our products, especially as our flagship program, Bayanihan CARES which provide very soft terms. These terms are needed because of the current pandemic situation. They were designed so that they could really help and not become an added burden in the future. That is why there was a grace period of up to one year and up to four years to pay, on top of the zero interest and zero collateral required.

We could say that we have met the demand to the extent of the availability of the funds provided us by the National Government. An exception is the loan uptake for the CARES for TRAVEL Program which has been slow to take off because of the restrictions in traveling.

Which among your programs were most sought by MSMEs? Can you provide us figures illustrating this increase in demand?

SB Corp. has since been offering regular retail, wholesale, and microfinance wholesale lending programs to MSMEs and partner financial institutions. These are regular products which are offered based on the current market rates. When the COVID-19 pandemic happened, SB Corp. came up with the CARES Program in May 2020. This recovery financing assistance program has become the most sought-after program to date. With the initial P1.5 billion using SB Corp.’s P3 program fund, it expanded with the additional capitalization of P8.08 billion that was provided to SB Corp. upon the enactment of the Bayanihan 2 law in September 2021. The expanded CARES program is re-launched in October 2020 as “Bayanihan CARES.”

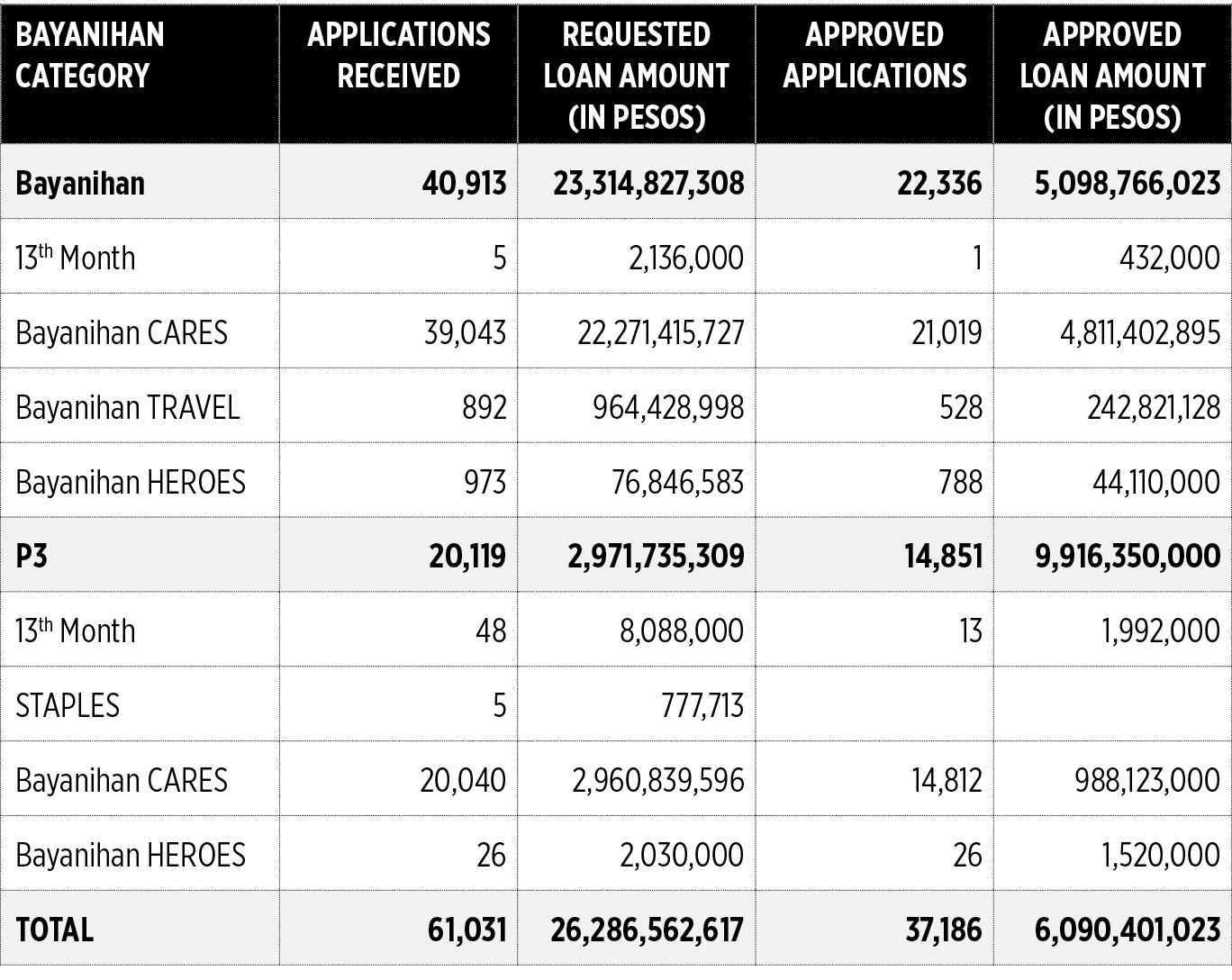

We received a total of 61,031 applications of which 37,186 have been approved as of Nov. 10, 2021. The total approved loan is P6.09 billion.

Among your Company’s target MSME segments, which one required the most assistance? What kind of assistance were provided to said segments?

Our existing financing programs and guidelines were designed to respond to the financing needs and realities of the different segments we serve. As such the segments can effectively access our products and services.

However, due to the very small sizes of their micro businesses, it is difficult to cater to clients of the P3 program on a retail basis. To improve access, we partnered with different private financing institutions who can identify them and visit them on a more regular and frequent basis. We provide soft, wholesale loans to these institutions, which they can relend, also at low rates to end borrowers. These institutions include rural banks, microfinance institutions, cooperative rural banks, and mother cooperatives.

What were the company’s target outcomes for this year? Would you say these targets have been met?

We have set out to provide more than P12-billion worth of loans to MSMEs all over the country for 2021. This is a 70% increase over our target in 2020. This is a tall order, but we are doing our best to achieve it so that we could help alleviate the condition of more MSMEs, as instructed by the National Government. We are hopeful we can achieve this target by the end of the year.

What are some of your concerns that need to be addressed as we go into 2022?

One of our foremost concerns is the extent of recovery experienced by our client borrowers, due to the series of lockdowns and restrictions that were imposed in 2021. We are looking at their situation pro-actively so that we could be prepared to help when they encounter problems in repayment, such as helping them to re-structure their loans to make their payment terms even more affordable. We foresee this to be a major concern as we move towards 2022.

Is there something, in terms of regulation or public policy, which you would want to be passed or enforced to help MSMEs cope with the persisting effects of COVID-19? If so, what are these?

We would like to lobby for an increase in capitalization so we could serve the MSMEs more, especially the priority sectors that have not been fully integrated into the economic mainstream, or are still very vulnerable to external shocks, such as climatic, physical and health hazards like this ongoing pandemic. The backbone of a healthy economy are resilient and sustainable MSMEs, and the more we help the unfinanceable sectors, the more we provide opportunities for broad-based development across the country. We are currently studying the nature and magnitude of the financing needs of these sectors, along with their potential impact on economic growth and poverty reduction, especially in the poorest municipalities all over the country. From these studies that we are conducting, we hope to convince Congress to provide for more loan funds and increase our capitalization.

What can we expect for SB Corp. coming into next year? Will there be new offerings? Modifications in current ones?

There will be new product offerings as we continue to adjust and tailor fit our products to the needs of the MSME sectors that we serve. We constantly innovate and study how we can be most responsive within our mandate, while adhering to government laws, policies, and regulations.

Any advice you can give to small- and medium-sized business owners coming in to 2022 and the years ahead?

We think they should all adjust to the so called new normal. This includes accessing financing assistance online, doing marketing online, availing of training and product development assistance online, and so on. Technology will be a key component and driver of success, even for MSMEs. We would advise our MSMEs to embrace this direction and prepare for it. Obviously, many are still technologically handicapped or have some aversion to using the internet for business and government transactions, or even just to obtain important information. As more and more people embrace mobile phone technology and online payment solutions, the MSMEs should also level up with the market, no matter how small they are. Information technology is a great equalizer.

We would also advise them to be on the lookout for government programs that try to assist them and be open to be accountable and responsible partners of the government in the growth of their businesses, and in the development of our country.

Anything else you would like to share with us?

Visit our website, www.sbcorp.gov.ph and our Facebook page, Small Business Corp. (facebook.com), to learn more about us.

Expanding MSME reach: A Q&A with Small Business Corp.

Source: Bantay Radio

0 Comments