By Mariedel Irish U. Catilogo, Researcher

THE PHILIPPINES’ trade-in-goods deficit in March widened to its highest in two months as exports and imports continued to fall.

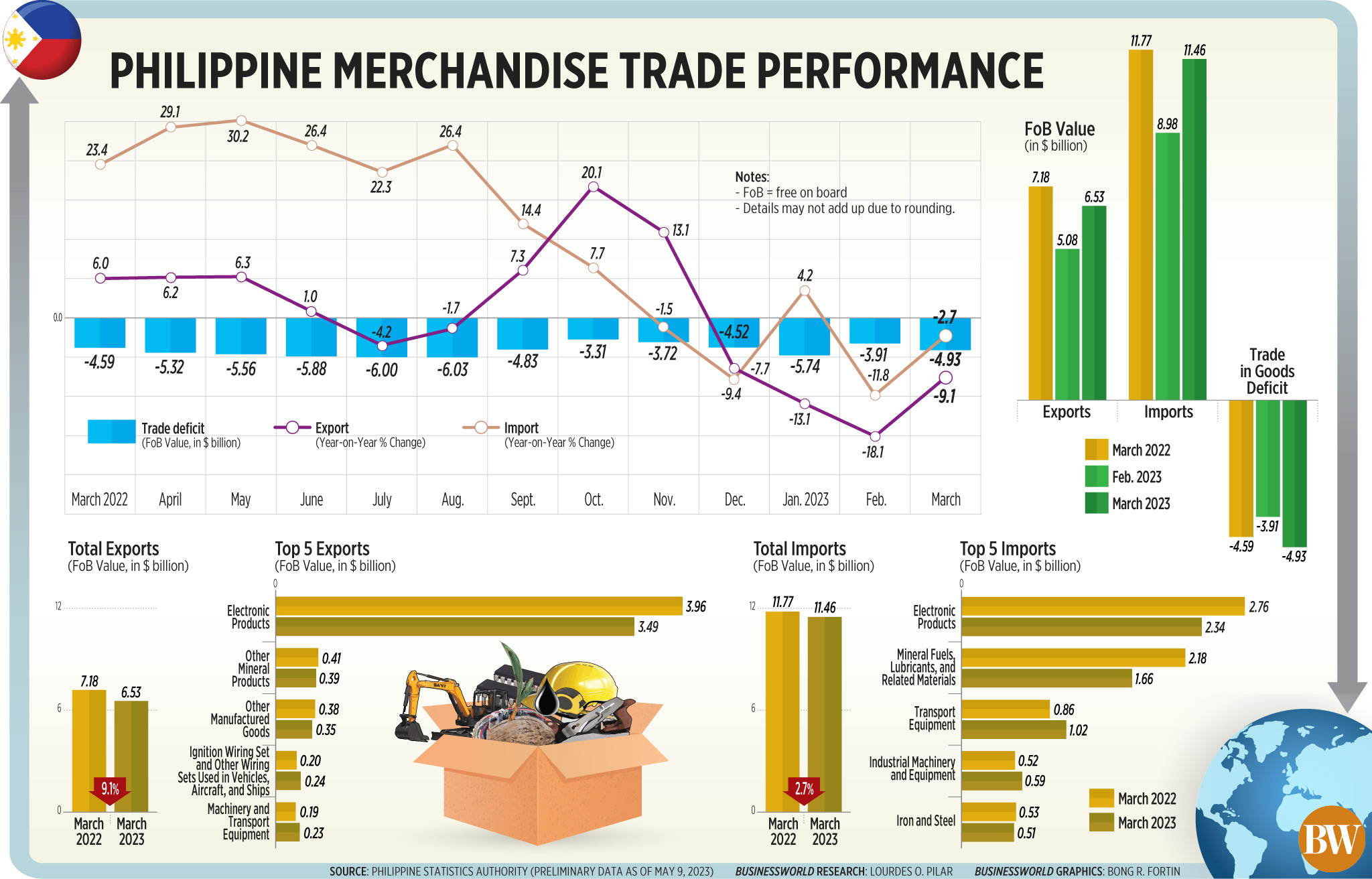

Preliminary data from the Philippine Statistics Authority (PSA) showed the trade-in-goods balance — the difference between exports and imports — amounted to a $4.93-billion deficit in March, ballooning from the $3.91-billion shortfall in the previous month and the $4.59-billion deficit in March last year.

This was the widest trade gap in two months since the $5.74-billion deficit in January this year.

On a monthly basis, the country’s trade balance has been in deficit for nearly eight years (94 months) or since $6.5-million surplus posted in May 2015.

Total outbound sales of Philippine-made goods declined by 9.1% year on year to $6.53 billion in March, slower than the revised 18.1% drop in February and a reversal from the 6% growth seen in the same period last year.

March marked the fourth straight month of exports decline.

Despite this, export value in March was the highest level in four months or since the $7.10 billion in November last year.

Likewise, the country’s merchandise imports fell for the second straight month. Imports dropped by 2.7% year on year to $11.46 billion in March, slower than the 11.8% decline in the previous month. However, this was a reversal of the 23.4% growth in March 2022.

The March import bill stood at a six-month high or since the $12.01 billion in September 2022.

For the first quarter, exports declined by 13.2% to $16.86 billion, while imports slipped by 3.3% to $31.44 billion. This brought the trade deficit to $14.58 billion in the first three months of the year, wider than the $13.08-billion gap in the January-to-March period last year.

The Development Budget Coordination Committee is projecting a 3% growth for exports and 4% for imports this year.

Security Bank Corp. Chief Economist Robert Dan J. Roces said the slower decline in exports and imports “may be a sign of some recovery in the country’s trade situation.”

“The sustained decline in exports also indicates that external demand in the global market remains weak. On the other hand, the slower decline in imports may suggest some improvement in domestic economic activity where we still see private consumption remain resilient, while also reflecting the country’s need to import raw materials and intermediate goods to support domestic production,” Mr. Roces said in an e-mail.

Mr. Roces said exports will likely improve by the second semester, following the reopening of China’s economy.

“China’s reopening will benefit our exports mostly, so this impacts positively on GDP (gross domestics product). The slower first-quarter trade, however, along with inflation and rate hikes, affected household consumption. It may have contracted a bit, but growth will still remain positive, and decent,” he added.

Manufactured goods, which accounted for 78.3% of total March exports, contracted by 9.8% to $5.11 billion.

Electronic products, which made up 68.2% of manufactured goods and more than half of total exports, declined by 12.1% to $3.49 billion. More than three-fourths of this came from semiconductors, which also dropped by 9.2% to $2.72 billion.

Meanwhile, imports of raw materials and intermediate goods, which had 36.9% share, fell by 7.1% to $4.22 billion in March.

Imports of capital goods inched up by 0.3% to $3.89 billion, while consumer goods climbed by 31.3% to $2.25 billion in March.

On the other hand, mineral fuels, lubricants and related materials fell by 23.9% to $1.66 billion in March.

China was the main destination of Philippine-made goods in March, with exports reaching $1.42 billion. This accounted for 21.8% of the total exports during the month.

Other top export trading partners included Japan (15% or $980.34 million), and the United States (13.4% or $877.89 million).

China was also the main source of imports in March with a 22.4% share or $2.57 billion of the total bill. This was followed by Indonesia (9.5% or $1.09 billion), and Japan (8.4% or $958.96 million).

Philippine Exporters Confederation, Inc. President Sergio R. Ortiz-Luis, Jr. expects the country’s trade situation to improve as supply chain issues are resolved.

“I think we are back to the pre-pandemic trade performance at some extent… Trade will be better and better because of economic recovery among others and due to worldwide improvement of the supply chain,” Mr. Ortiz-Luis said in a phone interview.

The latest trade data likely reflected the economy’s “moderate” growth in the first quarter, China Banking Corp. Chief Economist Domini S. Velasquez said in a Viber message.

“Currently, China’s demand for goods has not materialized too much in the first quarter. However, moving forward, we expect Chinese demand for goods to pick up. The recent trade data portends to better outlook from China,” she said.

The PSA will release first-quarter GDP data on May 11.

March trade deficit widens to $4.9B

Source: Bantay Radio

0 Comments